Some Known Details About Lighthouse Wealth Management

The Best Guide To Private Wealth Management Canada

Table of ContentsLittle Known Questions About Tax Planning Canada.The Facts About Independent Financial Advisor Canada RevealedGetting The Private Wealth Management Canada To WorkInvestment Consultant Fundamentals ExplainedSome Known Details About Investment Consultant Investment Consultant - The Facts

“If you were buying something, say a tv or a personal computer, you'll need to know the requirements of itwhat tend to be their components and just what it can create,†Purda details. “You can contemplate getting monetary guidance and support just as. Folks need to find out what they're getting.†With monetary information, it’s important to just remember that , this product isn’t securities, shares or any other assets.It’s things like cost management, planning retirement or paying off financial obligation. And like purchasing some type of computer from a reliable business, customers want to know they might be purchasing financial information from a dependable expert. Among Purda and Ashworth’s best findings is around the fees that monetary planners charge their customers.

This conducted real irrespective the fee structurehourly, payment, assets under control or flat rate (when you look at the learn, the buck value of costs was the same in each instance). “It nevertheless relates to the value idea and doubt on buyers’ part that they don’t determine what they might be getting back in exchange of these costs,†claims Purda.

Investment Consultant Fundamentals Explained

Listen to this particular article whenever you hear the term financial consultant, exactly what pops into their heads? Lots of people think about a professional who is able to provide them with monetary advice, specially when it comes to trading. That’s a good place to begin, but it doesn’t paint the full picture. Not even close! Economic experts can people who have a bunch of additional money targets too.

A monetary advisor can help you build wealth and shield it the overall. They are able to approximate your future monetary needs and plan methods to extend your own your retirement savings. They're able to also advise you on when you should start tapping into Social Security and making use of the funds inside pension accounts so you're able to abstain from any awful penalties.

The Greatest Guide To Retirement Planning Canada

Capable assist you to determine exactly what common funds are best for your needs and demonstrate how to handle and then make many of your opportunities. They can also support understand the threats and exactly what you’ll need to do to reach your targets. A seasoned financial investment professional will help you stay on the roller coaster of investingeven when your financial investments just take a dive.

They could supply you with the assistance you will need to develop plans to ensure that your desires are performed. And also you can’t place an amount label on the assurance that is included with that. Based on a recent study, an average 65-year-old few in 2022 will need around $315,000 stored to cover healthcare prices in your retirement.

The 8-Minute Rule for Financial Advisor Victoria Bc

Given that we’ve gone over exactly what economic experts do, let’s dig into the a variety. Here’s an effective principle: All financial planners are economic analysts, not all experts tend to be coordinators - https://www.livebinders.com/b/3567174?tabid=aaafba60-2a7e-3bde-f5e7-f44030d8dc70. A financial planner targets assisting people generate plans to attain long-term goalsthings like starting a college account or keeping for a down repayment on a home

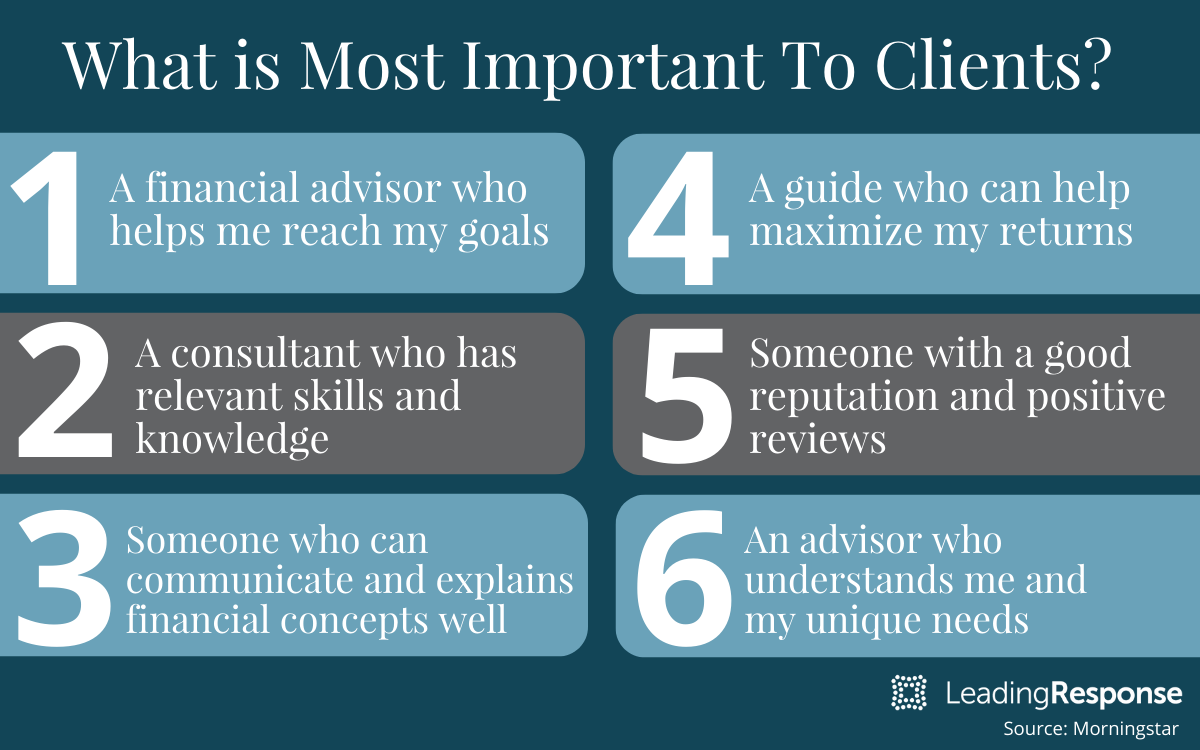

So how do you know which financial consultant is right for you - http://go.bubbl.us/dec75e/3e85?/New-Mind-Map? Here are some things to do to ensure you’re employing just the right individual. What do you do if you have two bad options to select from? Simple! Find more options. The greater number of options you may have, the much more likely you will be which will make a beneficial choice

Indicators on Tax Planning Canada You Need To Know

The wise, Vestor program causes it to be possible for you by showing you up to five monetary advisors who is able to serve you. The best part is, it’s free receive related to an advisor! And don’t forget to come quickly to the meeting blog here ready with a list of concerns to inquire of so you're able to decide if they’re a good fit.

But tune in, just because a consultant is smarter compared to typical bear doesn’t let them have the right to let you know what you should do. Sometimes, analysts are loaded with by themselves simply because they have significantly more levels than a thermometer. If an advisor begins talking down for your requirements, it’s for you personally to suggest to them the doorway.

Understand that! It’s essential along with your monetary consultant (whoever it winds up becoming) are on the same page. You want a specialist that a long-lasting investing strategysomeone who’ll convince one hold spending consistently whether the marketplace is up or down. financial advisor victoria bc. You additionally don’t wish to work with an individual who pushes you to spend money on something which’s as well risky or you are uncomfortable with

Some Known Details About Lighthouse Wealth Management

That combine provides you with the diversity you will need to effectively spend the long term. Just like you research economic advisors, you’ll most likely find the definition of fiduciary responsibility. All of this suggests is actually any expert you hire has to work such that benefits their own client and not their self-interest.